Do you want to know Chase Mobile Deposit Limit? in this article, I will be showing you how to know your Chase mobile limit for deposit and withdrawal.

What do you do when you want to deposit a check?

Simple. You walk down to your bank, meet a cashier and deposit the check. Alternatively, you can deposit checks at an ATM.

But do you know it can be simpler?

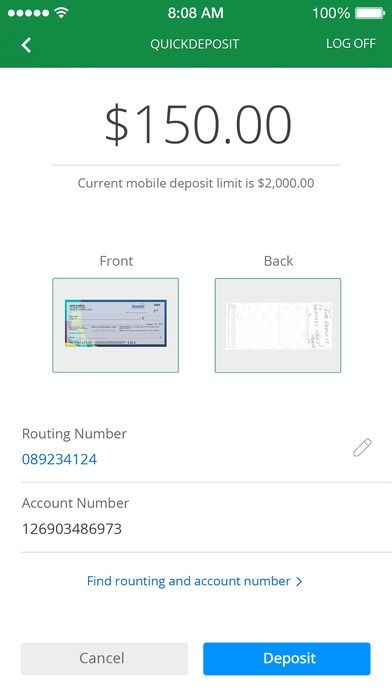

With Chase Bank’s QuickDeposit, you can deposit checks from the comfort of your phone by simply taking pictures of them. If you’re a Chase Bank customer and you have the Chase Mobile App installed on your device, you can use this service.

But it leaves a lingering question, what is Chase Mobile’s deposit limit?

This post will answer all your questions. Even if you don’t know what the phrase means, it will hold your hand and show you all you should know, trust me.

PAGE CONTENT

Chase Mobile Deposit Limit

While those are some of the common reasons why mobile deposits fail, we intentionally left one out.

If you’re wondering what we left out, it’s nothing but hitting your deposit limits. Once you’ve reached your mobile deposit limits, you won’t be allowed to make further mobile deposits.

The maximum amount that you can deposit using the Chase Bank mobile deposit is $2,000, over 24 hours.

While that amount might sound exorbitant, your face will fall when you realize that you can’t go over $5,000 in a month.

$2,000 daily and $5,000 monthly are not little figures, but given that face-to-face deposits do not impose hard limits, they might look small. If you have more checks or money to deposit, you can always visit a Chase Bank branch.

How to Get Around The Mobile Deposit Limit

If the limit sounds annoying to you, you have a choice. You don’t need to confine yourself to $5,000 in a whole thirty days. Here are some things you can do instead.

- Use an online bank

PayPal, Capital One 360, and Bank of Internet are all online banking solutions that allow you to deposit checks online.

However, these banks do not operate physical branches. Therefore, if you’ll deposit a check, you have only one option: using a mobile deposit.

Because there are not so many options, these banks will allow you to deposit significantly higher than traditional banks. For example, Ally Bank lets you deposit up to $50,000 in 24 hours, while the Bank of Internet accepts $10,000.

Cool right?

- Deposit at an ATM

If you’ve exhausted your mobile deposit limits for the day, why not walk down to an automated teller machine?

The deposits you make at an ATM won’t count towards your mobile deposit limits, and you can also deposit checks at Chase ATMs. If this solution sounds practical, then, why not?

- Mail the check to your bank

Many banks in the United States will let you mail checks for deposit. Chase is no exception.

If you still have some checks to deposit, you can simply mail them to Chase and wait for the bank to do the rest.

Note that you can’t mail cash for deposit with Chase Bank, only checks.

How Chase Mobile Deposits Work

If you’ve read up to this point, you should be aware that the Chase Bank mobile app lets you deposit checks by taking a picture of them, thanks to QuickDeposit.

But how exactly do you use QuickDeposit, and what specifics should you know?

Well, Chase’s mobile deposit is everything you think it is.

If you have a Check, and you want to deposit it into your account without having to walk down to your bank, you can do that by following the steps below.

- Open the Chase mobile app on your Android or iOS device. You’ll need to install the app if you don’t have it installed already.

- In the top left corner of the app’s interface, find and select “Deposit Checks.” If you manage multiple accounts from the app, you’ll need to select to which account you’re making the deposit.

- Enter the deposit amount on the check.

- At this point, find and tap “Front.” This will open the camera. Capture the front of the check using the camera. Ensure that it’s visible and not in low light.

- Tap next when you think you have an excellent picture. Using the camera, take a picture of the rear part of the check.

- Confirm the deposit and wait for the deposit to reflect on your account.

Once you confirm and submit the deposit, you should receive an email from Chase to confirm the receipt of your deposit.

Also, you should expect another email after Chase Bank has reviewed your deposit. This email will let you know if your deposit was accepted or rejected.

If that sounds like a lot of steps to you, try going to the bank to make the deposit.

Also, when you complete the steps above, write “Deposited” on the check using a pen. Do not discard the check until you receive an email notifying you of the success of your transaction.

Conclusion

Chase Bank is one of those banks that never lag when it comes to innovative banking services. At a time when many banks started accepting mobile deposits, Chase pulled ahead too.

Today, the Chase Mobile deposit limit is one of the most competitive among the banks in the US, and it will only get better.