He has agreed to pay you, but he asked you to send your $Cashtag. You don’t trust Cash App, but you have to do this.

You’re worried, and you keep asking: “Does Cash App charge a fee to receive money?”

Ask no more, as this is the article you’re looking for.

Payment services know how to market themselves as free services when they know too well that they hid charges somewhere, and you can’t find ways around them.

In this article, you’ll learn everything you need to know when receiving payments through the Cash App app. You’ll also learn about transfer fees and some other important charges, just in case.

PAGE CONTENT

Should You Receive Money Using Cash App?

Cash App is a mobile payment service available for Androids and iPhones in the United States and the United Kingdom only.

When you sign up for a Cash App account, you can apply for a cash card. Cash App cards look exactly like regular bank debit cards, except that they are customizable and even more functional

Should you receive money using Cash App?

Well, it depends on who you are and where you’re staying. If you’re not in the United States or the United Kingdom, trying to get a working Cash App by negotiating some workarounds mightn’t be worth it.

It takes a block for your funds to disappear.

However, if you’re in the United States looking to receive money from someone you know, Cash App is a strong contender for a payment method.

Also, if you’re selling or buying bitcoin and you want a solution that helps you control your money and your crypto from one place, Cash App has no competitors.

Disadvantages of using Cash App

Cash App isn’t the perfect payment solution without any flaws whatsoever. Before receiving money using Cash App, here are some caveats that shouldn’t be strange to you.

- You must have a Cash App account to receive money from Cash App

Although it’s very unlikely, you might want to receive money from someone that uses Cash App, when you don’t use the app yourself.

One challenge you’ll face in this setting is that it is impossible. You can’t possibly send money from Cash App to a bank.

Yes, you can withdraw to your bank account if you have it linked to your Cash App account, but you don’t want to link your bank account to a stranger’s Cash App, trust me.

- Unavailability around the world

Do you want to send some money to someone out of the United States?

Well, you are out of luck, as they can’t even find the Cash App on their App Store. At the moment, Cash App is only available in the United States and the UK only.

That’s too targeted than anyone would like. How hard is it to set up a global P2P payment system that lets me pay someone at the other end of the world and vice versa?

It seems like we have to keep looking.

- No phone support

I get sensitive when it comes to money matters. I always want someone to hold my hand and show me the way. This is something that isn’t available with Cash App.

Yes, they have a “Support” section on the app with hundreds of support articles, but you’ll agree with me that nothing compares to having a customer service agent that we can yell at when things go wrong.

If you made a transaction that didn’t reflect, prepare to bombard Google with questions.

- Limits

There is a limit to how much money you can receive on Cash App on any given day, especially if your account is not verified. An unverified account can only receive up to $1,000 in a thirty-day window.

Once you’ve verified your account, you can send up to $7,500 weekly, with no cap on the amount you can receive.

How to Withdraw money on Cash App

When you get paid on Cash App, you can easily withdraw the fees to your bank account, and in turn, withdraw them from an ATM.

Before you can withdraw money on Cash App, you should have enough money in your wallet. If you don’t have money to withdraw, you can receive money from friends and family. Here are the steps required to receive money from another Cash App user.

- Open the app to the numeric keypad interface and enter the amount you’ll like to receive from a fellow user.

- Under the numeric keypad, tap “Request.” You will be required to specify who you’re requesting the money from and what you’ll use the money for. Fill as required and continue.

- This sends a payment request to the user on the receiving end, and they can either choose to accept or decline the payment. If they accept the payment and they have enough funds to cover it, Cash App immediately deducts the specified amount from their accounts and credits it to your account.

The payment will fail if the recipient declines the payment; or if the payer doesn’t have enough money to cover the payment request.

Now that you have enough money in your Cash App account, you can proceed to withdraw your earnings into your bank account and eventually as cash.

There are two types of withdrawals on the Cash App, both with varying properties and fees.

- Cash App Card withdrawal

If you have a Cash App card, you can instantly withdraw funds from any ATM without having to initially withdraw them to your bank account.

- Withdrawal to bank

If you don’t have a Cash App Card, the most obvious alternative is withdrawing to your bank account and then withdrawing with your bank’s debit card.

Note that you cannot withdraw money from Cash App using your bank’s debit card.

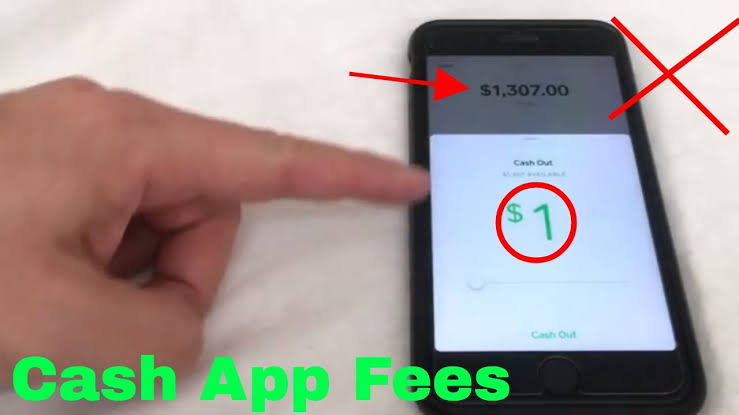

Does Cash App Charge a Fee to Receive Money?

No. If all you need to do with Cash App is to receive money, you’re never going to have to pay any charges.

However, I don’t see the possibility of someone receiving money without eventually having to withdraw them in the long term.

If you’re using the Cash App card, you don’t get to pay any ATM fees, apart from a $2 charge to Cash App.

Withdrawing to your bank is also totally free, although it can take up to three days for your funds to reflect in your account. If you want faster withdrawals, you can pay 1.5% of your withdrawal fee and have the funds almost instantly.

Conclusion

Receiving money on Cash App is free, no matter where you’re getting it from. Withdrawals aren’t total, but you get to pay an understandable $2 per transaction.

While this doesn’t break any records, it remains a modest way to receive payments from friends and family.

With this article, I hope you’ll not pull at your hair again with the question: “Does Cash App charge a fee to receive money?”