In this article we will be discussing PayPal friends and family limits, to enable you to know all the knowledge that’s involved when using the PayPal friends and family feature. PayPal is already the most widely used payment processor for businesses and individuals, but the Friends and Family (PPFF) service adds features that make it more useful. As long as users know how to take advantage of it, the service can be a great way to send and receive money to and from anyone, anywhere in the world, any time of the day.

This article will cover all PayPal friends and family limits as well as features that PayPal Friends and Family has to offer, and also show how Wise can be helpful for you.

- What’s PayPal friends and family?

- How PayPal friends and family work

- How to send PayPal friends and family

- Limits of PayPal friends and family

- PayPal family and friends VS goods and services

- Are the transactions Protected?

PAGE CONTENT

What’s PayPal Friends and Family?

As the name suggests, PPFF was created to be used specifically as a way to transfer money between friends and family members. It allows close networks of people to send and receive funds for personal use, as opposed to using PayPal for payment by businesses or business-related transactions. However, the Friends and Family method is attractive because of the benefits it offers for personal transfers.

How PayPal Friends And Family works

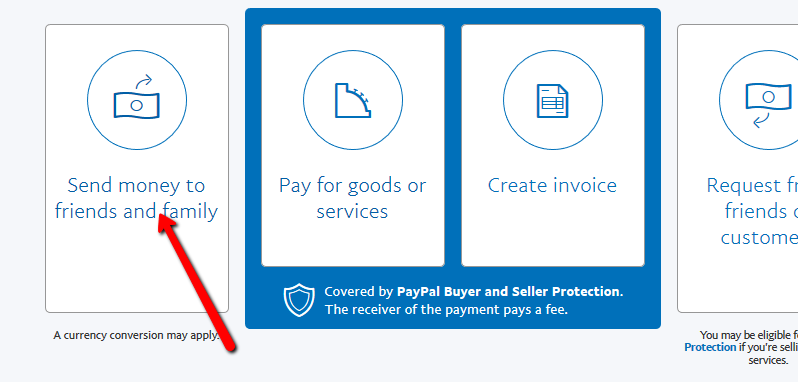

Using PPFF doesn’t require PayPal users to change how they interact with the payment platform. When preparing to send money to friends or family, PayPal asks the user to choose the purpose of the transaction, either “Sending to a friend” or “Paying for an item or service,” and the selection made determines whether the PPFF option is used or not. Based on that, the payment solution will automatically adjust the transaction to correspond to the correct transfer protocols.

How to Use PayPal Friends and Family

The following steps will enable you to send money using PayPal to friends and family, you don’t need any special or specific configurations on your account:

- Step 1: Log in to the PayPal account

- Step 2: Select “Send & Request”

- Step 3: Input the recipient’s details using either the name, email address, or phone number in the “Send money” section

- Step 4: Choose “Sending to a friend” when prompted

- Step 5: Enter the payment amount and add a note, if desired

- Click Submit

Limits of PayPal Friends and Family

Let’s take a look at the PayPal friends and family limit for transferring money to your family and friends. If your account on PayPal has been verified already, then you only have a limit per transaction, which can go up to $60,000 but may be limited to $10,000. PayPal doesn’t place a limit on the total amount of money, or the number of transactions, that can be sent using the PPFF service on a daily, weekly, or monthly basis.

This means that for transactions within the US, it’s possible to send two $10,000 transactions to the same recipient in a single day. However, this implies that the sender has a verified PayPal account. Sending money to international recipients will have different limitations, which depend on the destination country and the status of the recipient account (verified or unverified) on PayPal. Before trying to send large amounts, it’s suggested that you determine the PayPal friends and family limit and, with all transactions, only send money to those who are legitimately friends or family.

In case you don’t have a PayPal account, you’re able to do a one-time transfer of up to $4,000

PayPal Friends and Family vs Goods and Services

- PayPal Friends and Family:

PPFF is PayPal’s option for sending money or gift cards for all non-commercial activities between friends and family. Nonetheless, paying for goods or services, it’s not the best option. It could lead to the loss of money and/or goods. Just before you pay to finish the payment, you can choose whether to pay it or to change the payment to a Goods and Services payment, therefore passing the fee onto the recipient.

- PayPal Goods and Services:

The Goods and Services option is used to buy services or items and includes payment protection from PayPal. It charges the seller a fee to receive your money, and therefore the payments are automatically covered by PayPal’s protection policy in case anything goes wrong.

Are the Transactions Protected?

PPFF transactions aren’t inherently protected by PayPal (the option has to be chosen when sending money), therefore buyers do not have any recourse if something goes wrong when purchasing something using the PPFF option.

PayPal’s Purchase Protection keeps most financial information private and prevents it from being shared with sellers. All transactions are encrypted and monitored and are covered under this protection, regardless of the origin and destination of the goods being purchased. This protection is not a basic component of PPFF transactions, which means that unless you are sending to a verified and legitimate friend or family member, you won’t be covered if something goes wrong.

PPFF is meant to be used for the user’s family and friends not the family and friends of other PayPal users. There can be cases where a user makes contact with someone and asks that they use the PPFF option and request an item being purchased be sent to “a friend” at a different address as a gift. However, the buyer can submit a claim to PayPal saying that the item was never received and a refund can be provided.

CONCLUSION

In general, having PayPal friends and family limit is very essential to your account, when a limit is set PayPal will ensure that you don’t make transactions above your limit to your family and friends.